Payroll withholding calculator 2023

Thats where our paycheck calculator comes in. Features That Benefit Every Business.

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

The National Insurance class 1A rate for 2022 to 2023 is 1505.

. See how your refund take-home pay or tax due are. Ad Compare This Years Top 5 Free Payroll Software. Then look at your last paychecks tax withholding amount eg.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding. Estimate your federal income tax withholding. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Employers and employees can use this calculator to work out how much PAYE. 2022-2023 Online Payroll Tax.

Deductions from salary and wages. The Tax withheld for individuals. The Calculator will ask you the following questions.

Tax withheld for individuals calculator. There are 3 withholding calculators you can use depending on your situation. The Latest Payroll News New Zealand 2022 2023 Polyglot Group Prepare and e-File your.

Prepare and e-File your. How It Works. For example if an employee earns.

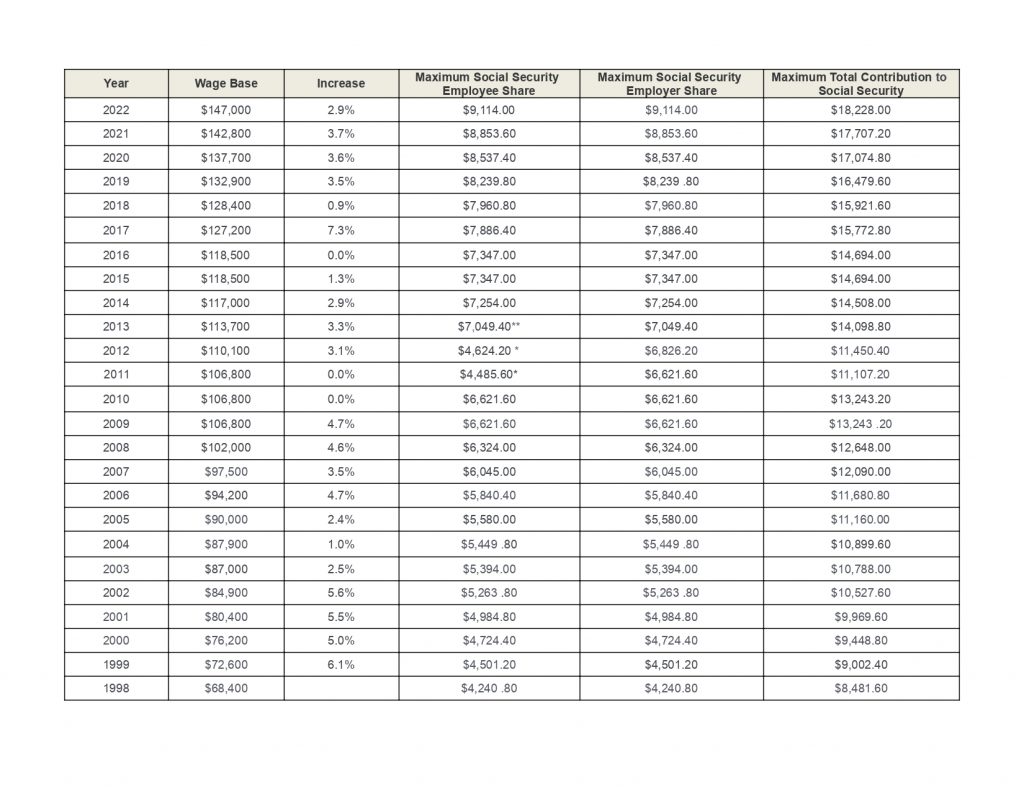

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. The maximum an employee will pay in 2022 is 911400. Estimate values of your 2019 income the number of children you.

Contact a Taxpert before during or after you prepare and e-File your Returns. Subtract 12900 for Married otherwise. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

This calculator is integrated with a W-4 Form Tax withholding feature. Choose the right calculator. See how your refund take-home pay or tax due are affected by withholding amount.

Start the TAXstimator Then select your IRS Tax Return Filing Status. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Based Specialists Who Know You Your Business by Name.

Use our PAYE calculator to work out salary and wage deductions. Use this tool to. Withholding schedules rules and rates are from IRS.

Free Unbiased Reviews Top Picks. All Services Backed by Tax Guarantee. 2022-2023 Online Payroll Tax Deduction.

Free salary hourly and more paycheck calculators. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Tips For Using The IRS Payroll Withholding Calculator.

How to calculate annual income. 250 minus 200 50. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The amount of income tax your employer withholds from your regular pay.

250 and subtract the refund adjust amount from that. For employees withholding is the amount of federal income tax withheld from your paycheck. Ad Payroll So Easy You Can Set It Up Run It Yourself.

That result is the tax withholding amount. Ad Compare This Years Top 5 Free Payroll Software. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary.

Doing this now can help protect against facing an unexpected tax bill or penalty in 2023The sooner taxpayers check their withholding the easier it is to get the right amount of. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free. 2022 Federal income tax withholding calculation.

All Services Backed by Tax Guarantee. Wage withholding is the prepayment of income tax. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

In case you got any Tax Questions. This calculator is integrated with a W-4 Form Tax withholding feature. Ad Payroll Made Easy.

Free Unbiased Reviews Top Picks.

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

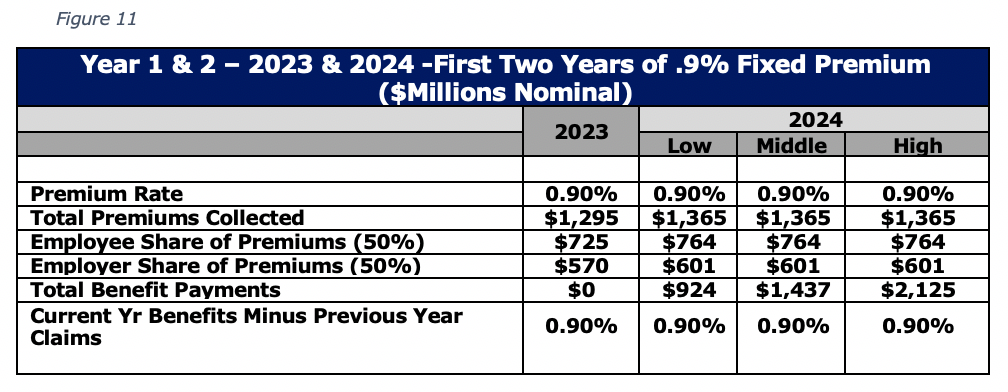

Proposition 118 A Statewide Paid Family And Medical Leave Program For Colorado But At What Cost Common Sense Institute

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Plan By Dec 31 To Claim Tax Breaks On 2022 2023 Returns

How Train Affects Tax Computation When Processing Payroll Philippines

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Payroll Tax Deductions Business Queensland

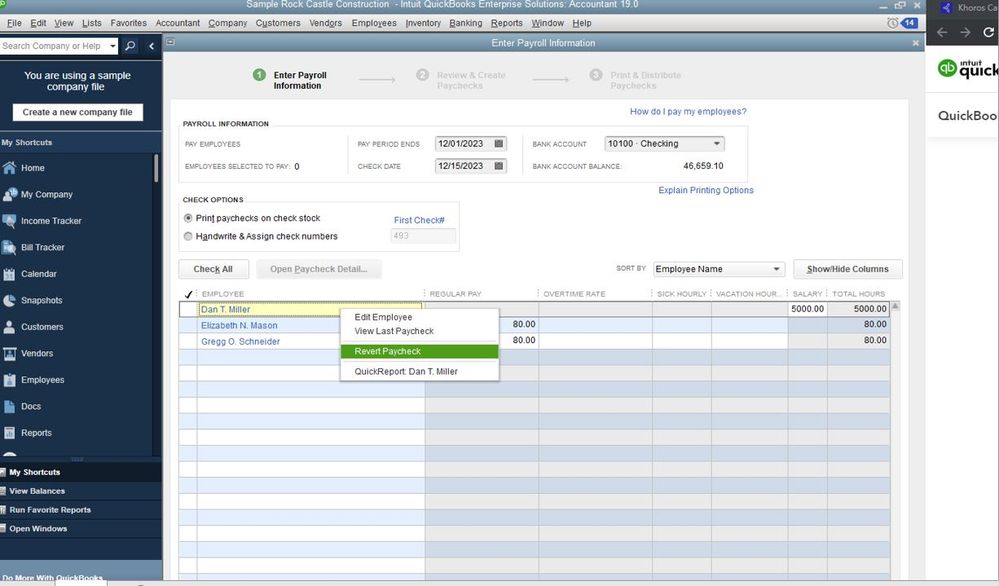

Solved Other Payroll Items Not Calculating User Defined Payroll Item

Ultimate Corporation Tax Calculator 2022

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

Income Tax Arrears Relief Calculator U S 89 1 Download

Tax Forms For 2024 Tax Returns Due In 2025 Tax Calculator

Tax Year 2022 Calculator Estimate Your Refund And Taxes